Our guides

-

Free checklist for your debt counseling

Vendor:SIC e.VRegular price €0,00Regular priceUnit price per -

What to do when the bailiff comes? – The most important tips and tricks

Vendor:SIC e.VRegular price €4,99Regular priceUnit price per -

What to do when the bailiff comes? – German-Turkish with integrated voucher

Vendor:SIC e.VRegular price €4,99Regular priceUnit price per

Download now

Initial consultation application form

Send us the completed application form without obligation so that we can advise and act as quickly and precisely as possible. We are your partner in this difficult time - with heart and mind.

Download now

Schufa information

A Schufa report is an essential step in clarifying your creditworthiness . It gives you a detailed overview of your financial obligations and helps you check your creditworthiness . This is particularly important for loan inquiries , rental agreements or larger purchases.

Download now

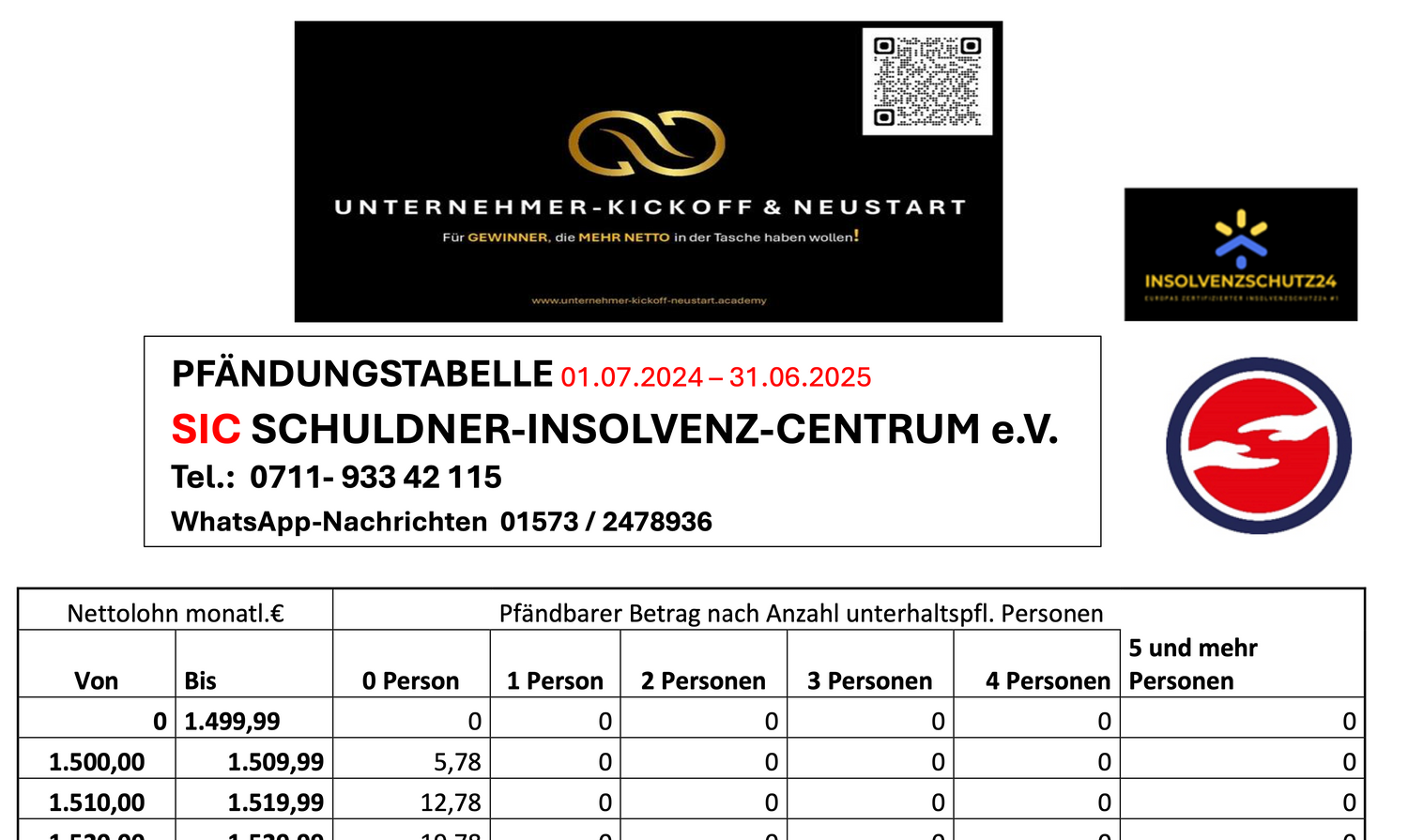

attachment table 2024/2025

The 2025 attachment table shows how much money is protected in the event of a wage garnishment . For debtors without maintenance obligations, around 1,410 euros remain exempt from seizure. Those who have to pay maintenance have higher allowances . Anything above this amount can be garnished.

Download now

insolvency checklist

All the steps you need to take to file for bankruptcy can be found in this document . It contains detailed information and practical tips to make the process easier for you.

Download now

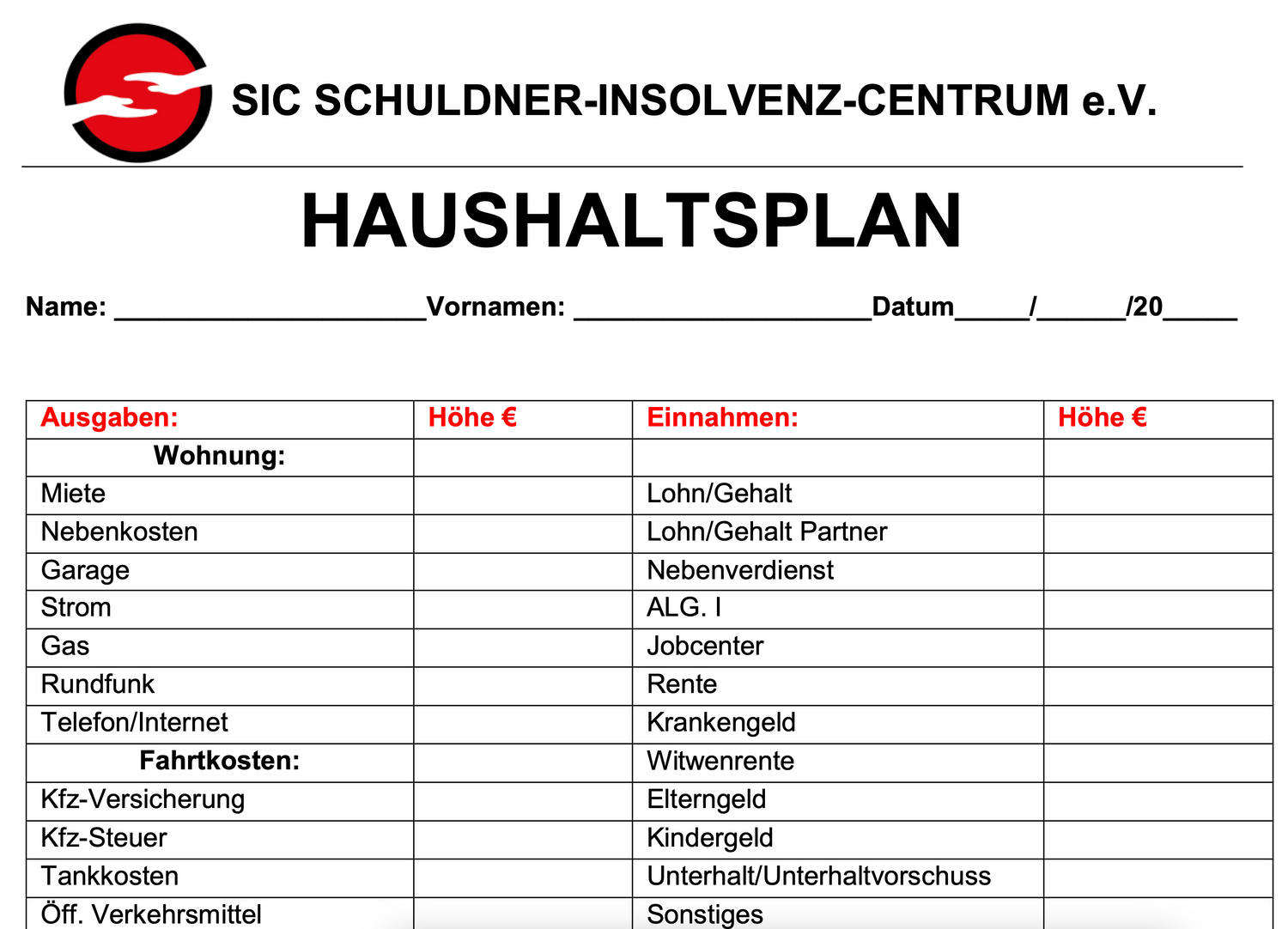

2025 budget

This document allows you to easily create your budget and keep track of all your income and expenses. It helps you organize your finances and keep track of everything .

Checklists & Downloads

Competent help with over-indebtedness - your partners in 2024

Our qualified debt advisors are always there for you. Arrange a free and non-binding initial consultation in our new, modern and very comfortable offices in Leinfelden-Echterdingen near Stuttgart .

You will receive within a few days or in very urgent cases even You can make an appointment without having to wait after you have filled out our registration form and sent it to us .

In this free information session you will gain an insight into our experience in the areas of insolvency and debt relief .

You will also receive additional tips and tricks (e.g. an account protected from seizure ) that my team and I have collected over the last 12 years. If you decide to work with us, you will receive individual support through regular consultations and insolvency assistance. We know from our own experience what it feels like to be burdened with debt .

We are happy to help you gain freedom and a new opportunity . We are at your side when it comes to selecting a suitable private insolvency or standard insolvency (business insolvency) for you!

Debt counseling with personal experience

Our board member Wolfgang Seelig has been insolvent himself before and knows how difficult it can be to find competent debt counseling and help. In the end, with the help of a lawyer and a lot of personal effort, he managed to get out of debt.

This experience led him to work as a volunteer debt counselor in 2007.

After successfully completing a course to become a state-approved debt and insolvency advisor, he founded his own advisory center.

The service is now available at 14 locations throughout Baden-Württemberg. Customers receive a free initial consultation on an equal footing and the guarantee of becoming debt-free within three years in accordance with legal provisions.

insolvency process

The Insolvency Code distinguishes between standard insolvency for entrepreneurs and simplified private insolvency proceedings .

Both go through the phases of insolvency application, opening proceedings, opening of insolvency proceedings, court date (creditors' meeting) and examination date .

In the subsequent liquidation phase, the insolvency administrator (or, in the simplified procedure, the trustee) implements the decisions of the creditors' meeting . He realises the assets and distributes them to the individual creditors, taking into account the attachment table .

After the sale and examination, the insolvency administrator submits a final report to the court . At the final hearing, the insolvency court approves the final distribution and terminates the insolvency proceedings after the assets have been distributed. For legal entities, the insolvency is then over. For proceedings concerning the assets of natural persons, a three-year period of good conduct follows. If there are no grounds for refusal, the court announces by order that the discharge of residual debt will be obtained provided that all legal obligations are met.

After the period of good conduct has expired, the court decides whether final discharge of residual debt will be granted. The debtor, trustee and insolvency creditors are consulted .

Get to know us - Wolfgang Seelig and his team are personally there for you!

Frequently asked questions about insolvency advice and debt settlement

What is insolvency proceedings?

An insolvency procedure is (simply put) a legal procedure that a debtor can apply for if he has long-term financial problems. Upon application to the responsible district court, a procedure is opened that includes all debts and all assets and carries out debt relief with the help of an administrator appointed by the court. This procedure is subject to conditions and cooperation, but ultimately results in "debt relief" so that a new financial start is possible for the person affected. We would be happy to explain the possibilities and limitations in detail in the free initial consultation.

Can anyone open insolvency proceedings?

In principle, yes. However, there must be a financial situation that justifies such a procedure, ie current income and existing assets are no longer sufficient to meet payment obligations (over-indebtedness). The debts must also be higher than the costs of the procedure. An unpaid fitness membership alone usually does not meet this requirement.

What documents are required for a consultation?

- current income certificate(s) such as wage/salary certificate, approval certificate, pension certificate, allowance, etc. If you have multiple incomes, all income certificates/certificates are required (e.g. for supplementary benefits ALGII)

- possible child benefit notice

- all reminders and enforcement notices (yellow letters)

- Evidence of unpaid invoices

- Reminders, debt collection letters, letters from lawyers, etc.

NOTE: These documents do not have to be pre-sorted, we understand if you are overwhelmed by the situation and will open/sort your letters for you.

Are there different insolvency procedures?

Yes. On the one hand, there is the consumer insolvency procedure and on the other hand, there is the standard insolvency procedure. Both procedures are identical in that they both involve debt relief and debt forgiveness.

- The consumer insolvency procedure (VI) applies to all dependent workers (workers, employees, pensioners, unemployed, etc.) but also to former self-employed people who have fewer than 19 creditors. In this procedure, it is legally required that, before the application is submitted, a recognized and approved insolvency advice center attempts to reach an out-of-court settlement with the creditors and, if this fails, issues a so-called negative certificate for the specific case. We are such a body and can issue this certificate.

- The standard insolvency procedure (RI) is a procedure for self-employed persons and freelancers who are currently maintaining their self-employment or for former self-employed persons who have claims from employment relationships of former employees or more than 18 creditors. In this procedure, it is not mandatory to involve an insolvency advisory center, but our experience shows that by involving one (our) advisory center, the chances of success are higher and, above all, mistakes are avoided that could lead to the failure of the procedure.

What does “attempt at an out-of-court settlement” mean?

The law stipulates that an application for consumer insolvency must always be preceded by an attempt to reach an out-of-court settlement with all creditors by a recognized insolvency counseling agency. This means that the counseling agency must try to reach an agreement with all creditors. The basis of the debt settlement plan to be drawn up is the debtor's attachable income and assets, possibly also supplemented by voluntary payments.

What happens next in court?

If the application for consumer insolvency, supplemented by applications for discharge of residual debt and deferral of procedural costs, has been submitted to the court, the first step is to check whether all information and attachments are complete. The insolvency judge will then decide on the opening of the proceedings (in the "normal" case, a so-called opening decision will be made).

In the course of this, the court appoints an administrator/trustee who is subsequently the responsible contact person, who is also tasked with the realization of any assets that may exist, to whom the debtor is obliged to provide information and to be accountable, who reports to the court during the good conduct phase that follows, who ultimately also prepares the final report and thus enables the court to decide on the discharge of residual debt (debt forgiveness).

Will I also incur costs in the legal proceedings?

Yes. Insolvency proceedings incur costs on the part of the court (court and procedural costs) and costs for the administrator/trustee. As a precaution, an application for a deferral of costs should be made in case the insolvency estate is not sufficient to cover these costs.

How long does a consumer insolvency procedure take?

Since January 2021, consumer insolvency proceedings only take 3 years instead of the previous 6 years.

What can I do if I no longer have any documents relating to my debts?

We can provide you with forms that you can use to request information from Schufa, other credit agencies, the debtors' register and bailiffs. However, you must make the enquiry from the bailiffs. We will advise you on how best to organize this. Simply speak to us about it during the consultation.

Can you help me with a certificate according to § 850c paragraph 4 ZPO (P-account certificate)?

Of course! Simply fill out the pre-made form on our homepage under the item "P-Account" and you will receive your certificate within 3-4 working days.

SIC SCHULDNER-INSOLVENZ-CENTRUM EV

President: W. Seelig

Hauptstr. 115

D-70771 L.-Echterdingen (near Stuttgart Airport)

Tel.: +49 (0)711-933 42 115

Fax: 49 (0)711- 46914839

WhatsApp: 015732478936

SIC SCHULDNER-INSOLVENZ-CENTRUM EV

President: W. Seelig

Hauptstr. 115

D-70771 L.-Echterdingen (near Stuttgart Airport)

Tel.: +49 (0)711-933 42 115

Fax: 49 (0)711- 46914839

WhatsApp: 015732478936

Competent debt and insolvency advice in the greater Stuttgart area

Welcome to the website of the SIC Debtor Insolvency Center e. V. in Stuttgart. We are your contact for all questions about debt and insolvency. Regardless of whether you are facing insolvency proceedings privately or professionally - we will help you professionally. Discover our advisory services and initial information about your options. We are here to help you!"

About Us

Find out more about me and my team at SIC Debtor Insolvency Center e. V. Our expertise is based on personal experience and professional qualifications.

Contact us

Do you have questions about insolvency advice or do you need support? Contact us conveniently via WhatsApp, telephone or email. Our team is ready to help you. Don't hesitate to contact us!